Report: Poor will pay more for roads

Published 10:42 pm Tuesday, April 23, 2013

By Amber Shiflett

Capital News Service

Virginia’s multibillion-dollar transportation funding package will put a heavier burden on lower-income households than on more affluent families, according to a Richmond-based think tank.

“The tax increases in the package would require low- and moderate-income Virginians to pay a bigger share of their earnings for transportation than wealthier households,” the Commonwealth Institute for Fiscal Analysis said in a recent analysis of House Bill 2313.

The General Assembly passed the legislation this year to create a long-term source of revenue for road construction and maintenance and mass transit.

The plan, which Gov. Bob McDonnell signed into law this month, raises the state sales tax from 4 percent to 4.3 percent. (In additional, local governments levy a 1-percent sales tax.) At the same time, the plan eliminates Virginia’s 17.5-cents-per-gallon gasoline tax, which McDonnell notes has been producing less revenue because of more fuel-efficient cars. The plan also imposes a 3.5-percent tax on the wholesale price of fuel.

The Commonwealth Institute, which describes itself as a nonpartisan group especially concerned about low- and middle-income Virginians, said the tax overhaul will hit lower-income Virginians the hardest.

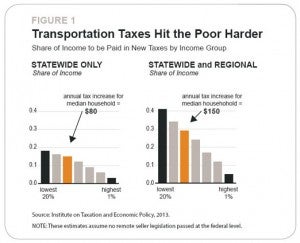

“On average, a median-income household in Virginia, earning about $51,000 annually, will pay roughly $80 more a year — around 0.2 percent of its income — in the new taxes included in the transportation package,” the report said.

“Households in the bottom 20 percent of the income distribution (earning less than $21,000) will pay between three and six times more of their income than the top one percent of households (earning at least $509,000).”

Suppose, for example, that a family scraping by on $15,000 a year pays an additional $60 in sales tax; that would represent 0.4 percent of its income. In contrast, if a household earning $500,000 a year pays an additional $500 in sales tax, that’s just 0.1 percent of its income.

The Commonwealth Institute cites another reason Virginia’s poorer households bear a heavier burden when sales taxes rise: “Low-income families also spend most or all of their earnings on goods subject to the higher taxes.”

Besides the increase in the statewide sales tax, residents of Northern Virginia and Hampton Roads will face an additional sales tax of 0.7 percent to fund transportation projects in those areas. The regional taxes will generate about $1.5 billion for the Northern Virginia Transportation Authority Fund and $1 billion for the Hampton Roads Transportation Planning Organization.

The increases in the statewide and regional sales taxes will take effect July 1. At that time, the total state and local tax will be 6 percent in Northern Virginia and Hampton Roads and 5.3 percent elsewhere in Virginia.

According to the Commonwealth Institute, low-income households in Northern Virginia and Hampton Roads will pay a portion of their income that is up to eight times higher than the portion paid by the richest 1 percent of households.

“The legislation includes no measures to make the funding responsibility more equitable,” the report said, suggesting Virginia use tax refunds or rebates to offset the impact of higher sales taxes on low-income families.

The institute also stated the transportation funding plan “shifts the cost of paying for highway improvements and routine maintenance away from drivers, who benefit the most from better roads. Less than 10 percent of the package resources come from driving-related revenues.”

Even so, car owners will feel some impact from the transportation funding law. It raises the sales tax on motor vehicles from 3 percent to 4.3 percent during the next four years. And the annual registration fee for hybrid, electric and alternative fuel vehicles will increase from $50 to $64.

Legislators acknowledged the bill was a difficult compromise.

“This transportation bill isn’t perfect, but it will fund the construction and maintenance we need to reduce gridlock, grow our economy and improve Virginians’ quality of life,” Delegate Charniele Herring of Alexandria, who chairs the Democratic Party of Virginia, said in a recent press release.

A fellow Democrat, Delegate Vivian Watts of Fairfax, agreed.

“It is an important step in moving Virginia forward. Virginians have waited too long for a long-term transportation funding plan, but now we have a plan that provides much-needed revenue to fix and build Virginia’s transportation infrastructure,” said Watts, a former state transportation secretary.

Still, the concerns raised by the Commonwealth Institute resonate with many Virginians.

Lauren Arcudi, a student at Virginia Commonwealth University from Reston, said she is relieved to see efforts to improve the transportation system, especially in congested areas like Northern Virginia.

But she added, “The sales tax increase is definitely going to affect me, because I am a student and I don’t make much money.”

Arcudi said the tax burden for the transportation program should be distributed more fairly. “The fact that bothers me the most is that the people with the less money have to pay more,” she said.