Arm’s-length or fair-market?

Published 9:17 pm Saturday, February 2, 2013

Karen and Perry Holland, at their Bridge Road home, review the supporting evidence they collected for an assessment appeal they launched for another property they own in the Quaker Neck subdivision. Suffolk's Board of Equalization had 140 appeals in 2012, proportionally much more than elsewhere in Hampton Roads.

Suffolk assessments draw more appeals than in any other Hampton Roads city

Perry and Karen Holland did their research before standing before a Board of Equalization hearing to contest the city’s assessment of their North Suffolk property.

They had bought the foreclosure in the Quaker Neck subdivision for $77,000 in November 2011. About three months later, the city assessor’s office had assessed it at more than $187,000.

“We went through and looked at each (nearby) property and how much it sold for,” Karen Holland said of their preparation for the 15-minute board hearing in a City Hall conference room.

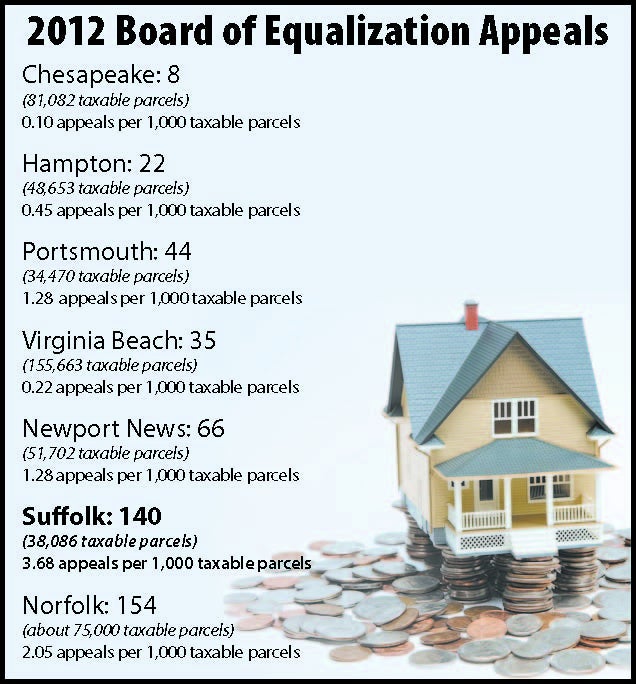

The Hollands weren’t the only ones last year to appeal their assessment to the independent panel of three court-appointed citizens. Far from it, in fact. Suffolk’s Board of Equalization handled 140 cases during a three-month span ending last July — far more in proportion to the number of taxable parcels than anywhere else in Hampton Roads, according to city records.

Suffolk had 3.68 board appeals per 1,000 taxable parcels, almost twice as many as in the Hampton Roads city with the second most — Norfolk — and 36 times more than in Chesapeake, with the region’s fewest.

Meanwhile, city records would seem to confirm what the Hollands and others have said about Suffolk’s assessments: Many Suffolk properties are substantially over-assessed.

Billy Chorey, who served as last year’s chairman of the Board of Equalization in Suffolk, would not speak on behalf of that board for this story. But as a longtime Realtor with a wealth of experience in the Suffolk market, he has a personal and professional opinion on the matter.

“It is my strong conviction that a majority of real estate assessments in the city of Suffolk are higher than their actual current fair market values,” he said recently. “That has been the case since the downturn of real estate values in 2009, and I see it every day in my business of selling and appraising properties here in Suffolk.”

John Harry and Mills Staylor, the board’s other two members, would not comment.

Central to Suffolk’s assessment problem is a dearth of qualified, or arm’s length, sales.

The city’s seven appraisers — eight including City Assessor Jean Jackson, who signs off on their assessments — prefer to rely only on qualified sales when determining “fair market value” — what a property will yield when the seller is not forced to sell and the buyer is not forced to buy.

Unqualified sales, on the other hand, include those like bank foreclosures, underwater sales in which the seller owes more than the house is worth, and builder liquidations in which the seller cannot afford to complete the construction.

According to city records, Suffolk in 2011 had only 664 qualified sales against almost twice as many, 1,174, that were unqualified. And while the average assessment for qualified sales was 108.95 percent of the sales price, it rose to 183.64 percent for unqualified sales.

Chorey is among those who believe that where unqualified sales are highly concentrated — like in Pitchkettle Farms off Route 58 and Quaker Neck in the Sleepy Hole borough, where the Holland family bought, and Governors Pointe off Route 17, where the city is facing an assessment lawsuit — such sales should be counted when assessments are done.

The argument goes that once a neighborhood reaches a certain proportion of unqualified sales, the true market value of all homes gets dragged down.

“What I personally believe is that if an area has a disproportionate number of unqualified sales, then that needs to be considered stronger with the valuations in that specific neighborhood,” Chorey said.

Perry Holland said he was left in “disbelief” by the city’s assessment on their Green Spring Drive property.

“I didn’t expect to buy something for $77,000 and for the city to assess it for $187,000,” he said.

The Hollands pursued an appeal to the board, each of whose three members has an equal vote, after an unsuccessful conference at the assessor’s office, the initial level of appeal.

“Most of them were from Quaker Neck … and the city wanted to call them builder liquidations,” Perry Holland said of the sales they presented to bolster their case. “None of the sales in the neighborhood were qualified.”

The board dropped the Hollands’ assessment to $107,700. “I still don’t think it’s fair,” Perry Holland said. “I would still say we’d have a problem getting $107,000 if we sold it.”

He believes the city intentionally keeps assessments high in order to raise more money in taxes.

“The more they’re worth, the more the city collects in taxes,” he said. “It’s the same thing with everything in life: money.”

Of Suffolk’s 140 board appeals, assessments were decreased for 99 parcels and increased for one, lowering the original combined assessments for the adjusted parcels by 15 percent, to $44.06 million.

Chorey believes that if the city needs to increase revenue to cover expenditures, it should increase the tax rate, currently set at 97 cents per $100 of assessed value, rather than inflate assessments.

“If the assessments come down to where I believe they should be, then the city may say, ‘We need more money.’ Well, then the city needs to raise the mill rate, not inflate real estate assessments,” he said.

During two interviews at City Hall, City Assessor Jean Jackson said she has been “picking up the pieces” of a department that was in disarray when she was officially named to her role in August 2011. She invited those upset with their assessment to contact her office.

“If we determine from sales that the land value needs to be adjusted, it’s going to be adjusted, whether it be down or up,” she said.

But Jackson also denied that Suffolk properties are over-assessed. “All sales are given their due-diligence weight in determining what are qualified or unqualified sales” for assessment comparisons, she said. State guidelines do not permit direct comparisons of non-arm’s-length sales for assessments, she added.

But then Jackson gave one indication that the city’s policy might shift. After leaving the conference room momentarily to consult in private with city Chief of Staff Debbie George, who sat in on both interviews, she returned and said there are “certain subdivisions” where “certain circumstances” will come into play.

New assessments are due to be mailed out this month.