Debt: You owe $3,729

Published 10:35 pm Tuesday, May 7, 2013

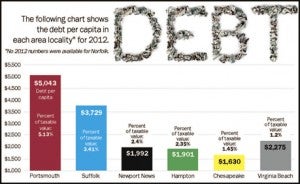

Suffolk residents owe more debt per capita on the city’s general debt than citizens of any other Hampton Roads city except for Portsmouth.

In fiscal year 2012, the most recent year for which data was available, every man, woman and child in the city owed $3,729 on the city’s general debt.

The number has risen steadily since 2003, when the per-capita debt was $2,084. That’s a 79-percent increase.

But the percentage of the taxable property value, which Suffolk budget director Anne Seward says is a better measure of the debt level, has fallen to 3.41 percent from 2003’s 3.9 percent, though percentage has doubled since 2011, because the city had to issue a significant amount of general obligation bonds in 2012.

“The rating agencies basically talk about our debt as being moderate,” Seward said. “Over the years, we’ve brought that down.”

The city’s financial policies restrict its debt to less than 4 percent of the taxable property value.

Per-capita debt in other Hampton Roads cities ranges from $1,630 in Chesapeake to $5,043 in Portsmouth. The percent of taxable value ranges from 1.2 in Virginia Beach to 5.1 in Portsmouth.

In addition to Suffolk’s general debt, obligations falling under the category of “business-type activities” as reported in the Comprehensive Annual Financial Report, obligated each citizen for $5,662, more than double the 2003 total of $2,774 per person.

In the coming fiscal year, the city will go more than $50 million deeper in debt — $34 million for general projects and $16 million for utility projects.

The debt includes school and transportation projects, as well as emergency communications equipment, Seward said.

The city expects to pay off more than $26 million in debt this year, but that total could change if any opportunities to refinance arise, Seward said.

Seward said she believes the city’s current debt load is reasonable.

“I wouldn’t be recommending it if I didn’t,” she said.