Suffolk explores reduction in real estate tax rate in proposed 2024-2025 budget

Published 7:57 pm Thursday, April 4, 2024

|

Getting your Trinity Audio player ready...

|

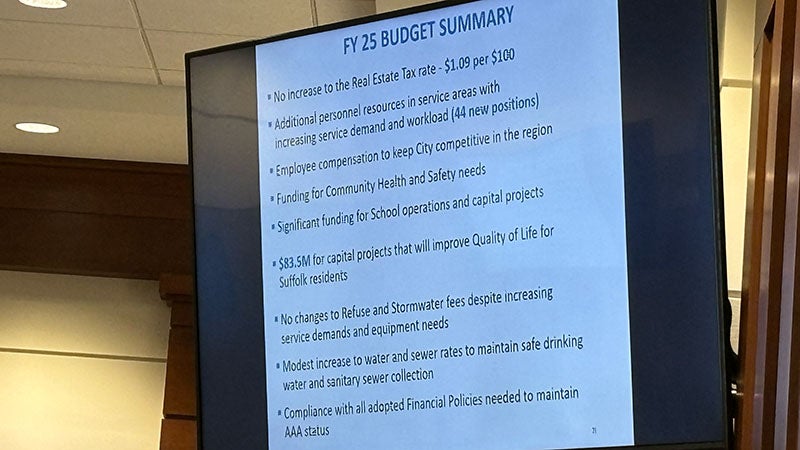

In a vote of 8 to 0, Suffolk City Council approved a motion to have the city manager amend the real estate tax rate in the proposed 2024-25 budget. The proposed budget did not include a change to the $1.09 rate. However, councilman Roger Fawcett motioned to reduce the rate to $1.07.

The reduction would amount result in an approximate decrease in revenue of $3 million. This is after the city says it realized an increase in revenue of $21.3 million over the previous year.

Mayor Michael D. Duman supported Fawcett’s motion to offer an “opportunity” for tax relief for Suffolk residents.

“I fully support Councilman Fawcett’s motion,” Duman said. “I think it’s warranted, and I think our citizens deserve the relief that we can pass along to them and we will be reviewing that amended budget when we come back at our next meeting for approval.”

Financial Director Charles Meek provided an overview of the council’s proposed budget of $882,100,325.

“While any budget never addresses all the funding requests and needs that are out there, I think you will find that this budget moves the city forward and addresses critical operational needs and demand for services and remains true to our financial principles that have allowed Suffolk to maintain our triple-A bond rating,” Meek said.

Critical Personnel Needs and Community Health and Safety

The presented budget priorities focus on maintaining Suffolk’s service levels through growth with no tax rate increase, providing quality of life through capital improvements, and more.

In addressing critical personnel needs and employee compensation, the budget detailed plans to add 44 new full-time positions to address Suffolk’s growth and demand while remaining competitive in the region. The budget also includes a 4 percent cost-of-living adjustment (COLA) for full-time, part-time and grant employees, a One Step increase for sworn police personnel, Step Plan adjustments for qualifying employees and more. Along with an increase in community health and safety positions such as police and fire and rescue, investment in local service partners providing critical need services sees a $274,000 increase. These partners include the Western Tidewater Community Services Board, Genieve Shelter, Foodbank of Southeastern Virginia, Suffolk Christian Fellowship Center, Meals on Wheels of Suffolk/Isle of Wight and more. Emergency shelter operations see a total of $850,000 in funding.

Public Education, Quality of Life investments and AAA status

Public Education sees $75.3 million for school operations, which sees a $4 million increase, and $2 million in additional funding approved by the council for school safety measures in October. A recommended $28.6 million in capital funding is seen for the John F. Kennedy Middle School replacement ($25 million) and Northern Shores Elementary Addition projects ($3.6 million). Along with $739,702 for school administration and operations building leases, which sees a 296,000 increase, the city-funded debt service for school projects sees $11.5 million.

“This is a $400,000 decrease,” Meek said. “However, expect that to ramp back up over the next few years as the JFK Middle School bond funding comes online.”

Quality of life through capital improvements sees $83.5 million in investment toward community infrastructure, with funding for Parks and Recreation facilities, public safety features, transportation improvements, water and sewer upgrades and more. $35.2 million is listed for bonds and literary loans towards general government capital projects, with 26.7 million of general fund cash for capital projects. Likewise, $7.3 million will be drawn from the capital reserve instead of the planned $11.9 million in the capital improvements plan. $8 million will also be used for a capital contingency to address construction inflation.

Meek says they comply with all their financial policies to maintain their AAA status.

“Our capital pay-go policy requires a minimum of 3 percent of general government budget towards capital projects. The proposed budget is at 11.5 percent,” Meeks said. “Debt as a percentage of assessed value, we need to maintain that below 4 percent. The proposed budget is at 1.4 percent. Debt as a percentage of general government expenditures needs to be maintained at or below 10 percent. This budget is at 6.2 percent.”

The unassigned fund balance is listed at 20.0 percent, with the budget stabilization fund at 2.5 percent. The capital reserve fund likewise sees a projection of $50.9 million. General fund revenue is projected at $324,213,302, which is an increase of $28,963,230.

As for the next steps, residents will have a chance to provide feedback on the proposed budget during a public hearing at April 17’s city council meeting. May 1’s public hearing will see the recommended adoption of the budget.

For the full budget document, go to suffolkva.us/174/Annual-Operating-Capital-Budget. To watch the full presentation, go to youtube.com/@CityofSuffolkVA.